How can we help?

Taxable Income Report

Available on Sharesight Starter, Standard, Premium and Sharesight Business plans.

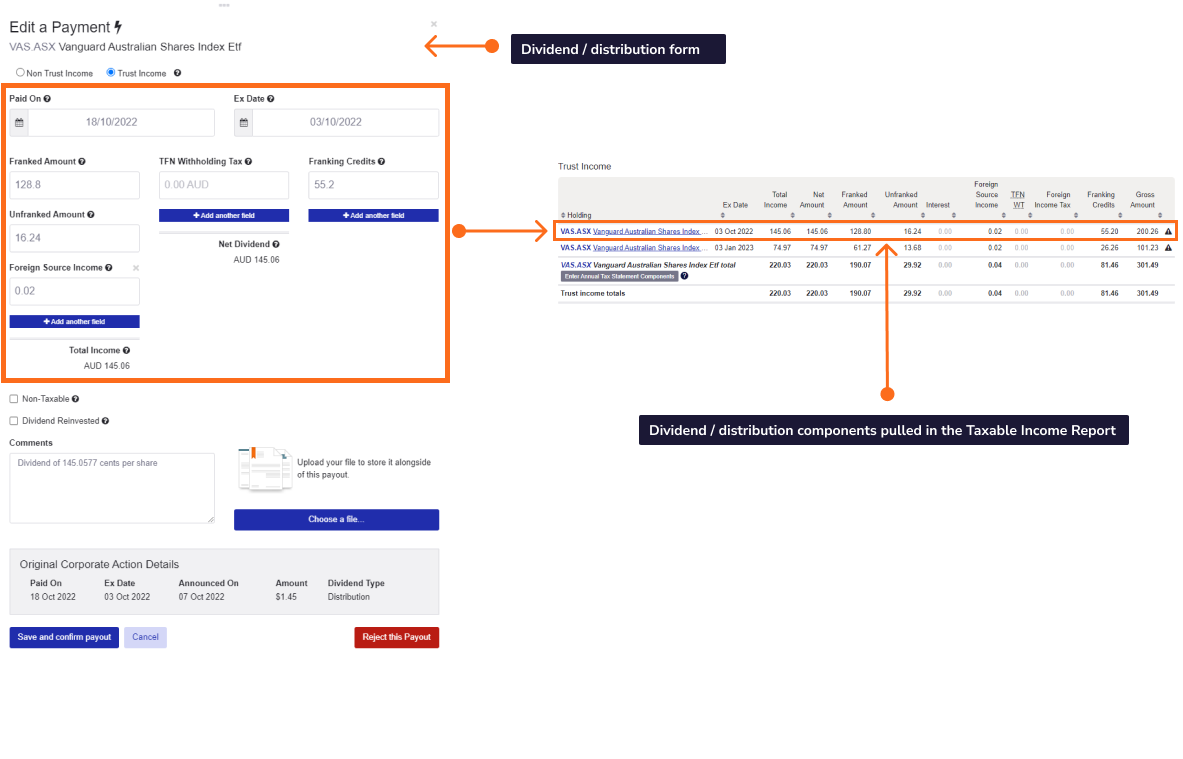

The Taxable Income reports lists all transactions for dividends, distributions and interest payments received within the selected date period.

The report is designed to provide the information relating to your portfolio that you are required to include in your tax return to the ATO.

Income is separated into:

- Local non trust income

- Local trust income

- Foreign Income

Taxable Income Report Overview

Embedded content: https://www.youtube.com/watch?v=3NnZOBWZeCM

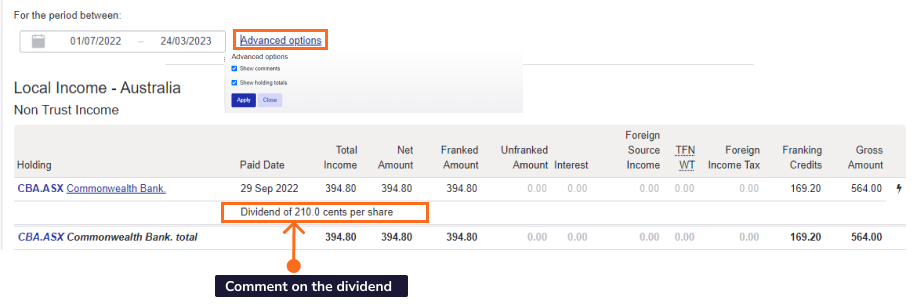

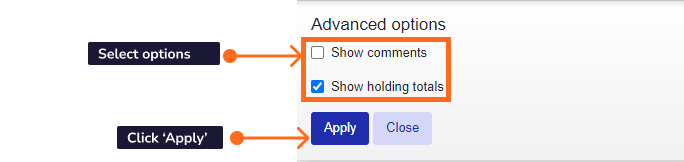

In ‘advanced options’ choose to:

Show Comments - display any comments associated with a dividend or distribution.

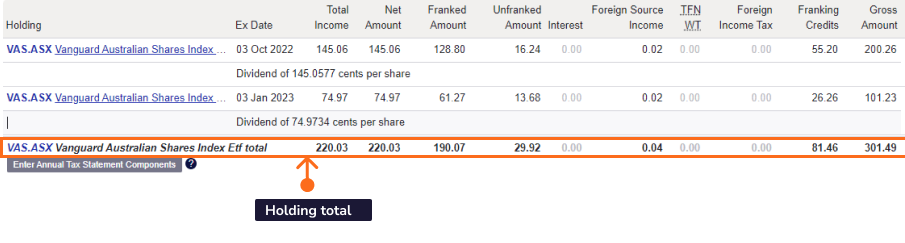

Show holding totals - displays dividend or distribution totals across all payouts for a single investment. This is particularly useful for reconciling your Sharesight distribution data with your annual taxation statement for each ETF, Managed Fund, or Unit Trust you own. Show need to be selected to use the Trust pro rata distributions components form.

Note: If no value is present for a specific taxable component, then the corresponding column may not be displayed. The data is taken from the payout form for each dividend and distribution.

![]() A lightning bolt icon indicates system calculated transactions that have not been verified. It is recommended you verify automatically generated transactions.

A lightning bolt icon indicates system calculated transactions that have not been verified. It is recommended you verify automatically generated transactions.

Click on any column heading in the tables to reorder the table by the contents of that column.

Click on the transaction to edit and to verify the system generated payment.

Columns within Local Non Trust & Trust Income tables:

Paid Date / Tax Date - The date that the payment is credited to you.

Total Income - The date on which your dividend entitlement is calculated. The dividend is included in your performance calculations based on the ex date.

Net dividend - This is the total income figure less any withholding tax that has been deducted. This is the amount of the cash that you actually receive.

Franked amount - The amount of dividend that has franking credits attached.

Unfranked amount - The amount of Australian source assessable dividend that does not have franking credits attached.

Interest - The amount of interest.

Tax Deferred - Tax deferred income. This amount is non-assessable and is used to adjust your cost base for CGT purposes.

AMIT Decrease - Relevant for attribution managed investment trust (AMIT) when the taxable income attributed to you is less than the cash distribution you recieved. This amount is non-assessable and is used to decrease your cost base for CGT purposes.

AMIT Increase - Relevant for attribution managed investment trust (AMIT) when the taxable income attributed to you is more than the cash distribution you recieved. This amount is non-assessable and is used to increase your cost base for CGT purposes.

Foreign Source Income - The gross amount of non Australian assessable income (before deduction of any tax credit).

Discounted Capital Gains - This is grossed up and included with you capital gains on the CGT report.

CGT Concessions - The amount of any CGT discount included in the distribution. It is non-assessable and does not alter the cost bas or reduced cost base.

Non Assessable - This is used to reduce you reduced cost base. It does not affect your cost base.

TFN Withholding Tax - The amount of any Australian tax that has been deducted. This typically only occurs where your tax file number has not been provided.

Foreign Income tax - The gross amount of non Australian assessable income (before deduction of any tax credits).

Franking Credits - The amount of franking credits attached to dividend.

Other Net FSI - The amount of non Australian assessable income (before deduction of any tax credit) after offsetting any allowable expenses or losses relating to foreign source income. This value does not affect your total income.

LIC Capital Gain - The amount of an LIC dividend that is attributable to an LIC capital gain. An LIC shareholder who is a australian resident when the dividend is paid will be entitled to an income tax deduction of 50% of this value.

Gross Amount - The total amount before anything is deducted.

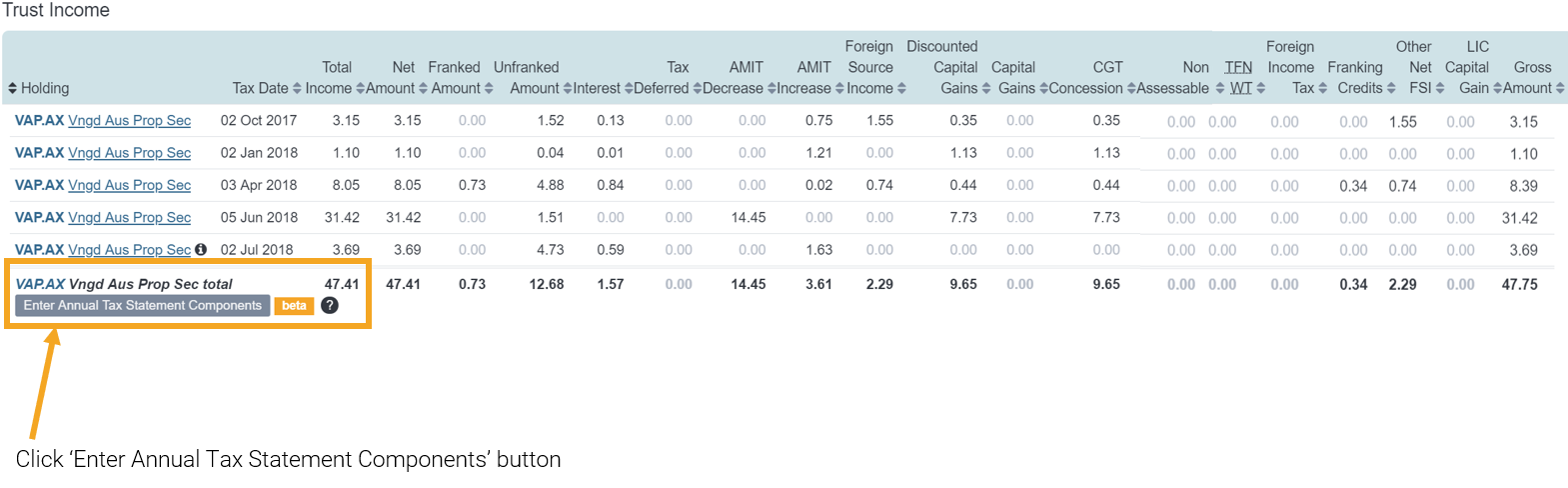

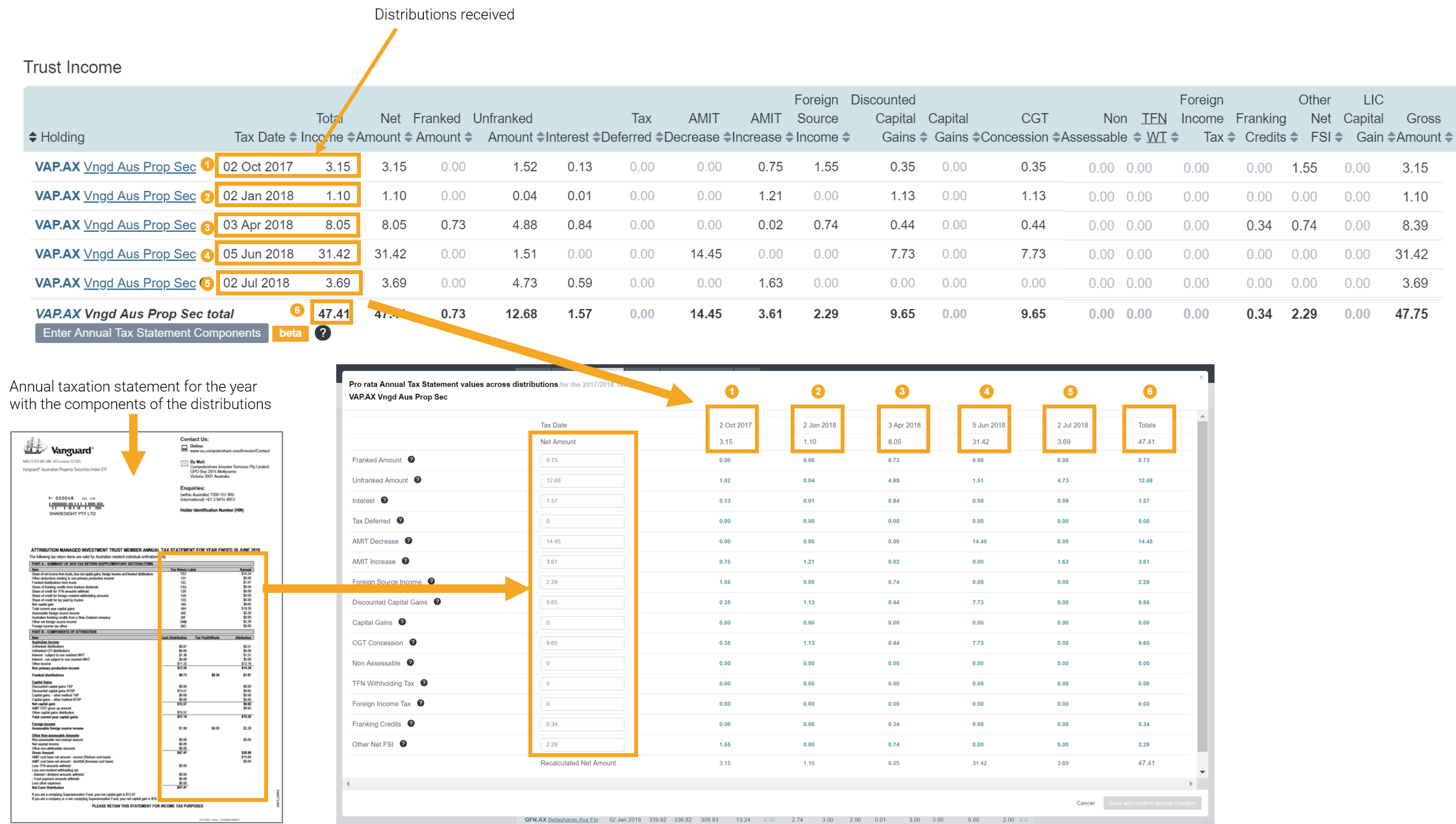

Trust pro rata distributions components form

Embedded content:https://www.youtube.com/watch?v=H6KeSGWPeWw&t=112s-oRivA

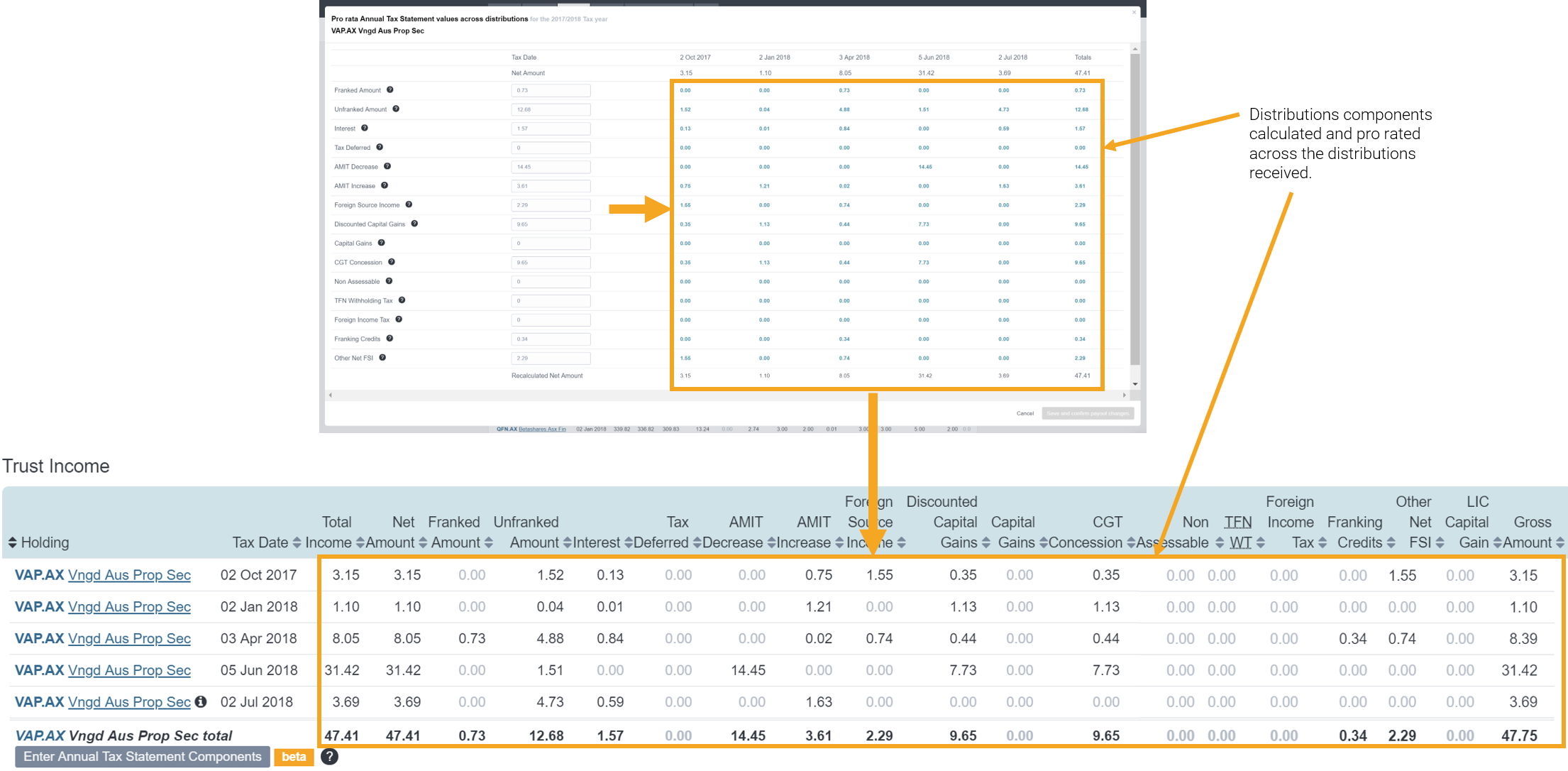

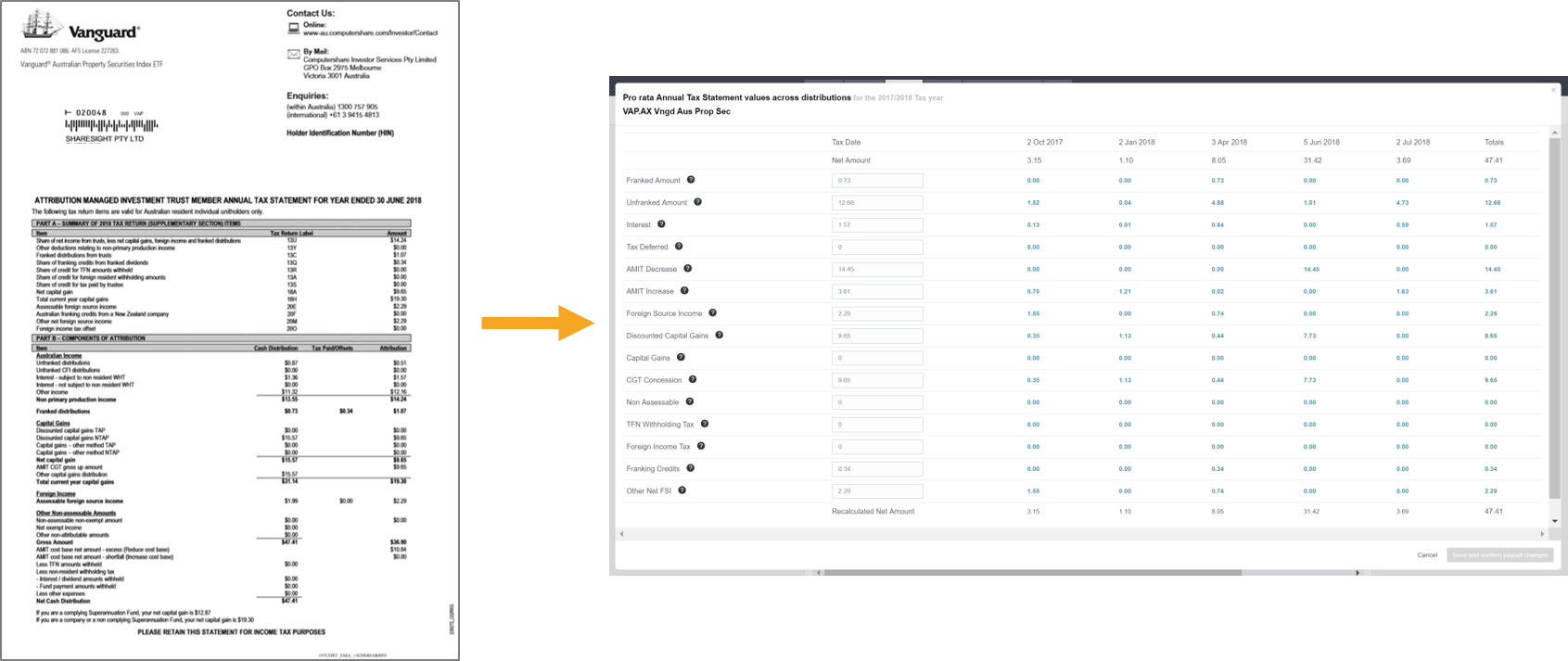

The tax components on a trust distribution are typically estimated at the time of payment and not finalised until after the end of the tax year. In this case the finalised components are provided in an annual taxation statement. As the annual taxation statement only provides the annual totals, it is necessary to allocate these amounts across each transaction in Sharesight (typically distributions are made on a quarterly or monthly basis).

This form enables you to enter the amounts from the annual taxation statement.

Trust pro rata distributions components form is available for trust income when the date range is selected for a financial year and ‘Show holding totals’ is selected in the ‘advanced options’.

Click on the ‘Enter Annual Tax Statement Components’ button beneath the trust distribution totals.

Sharesight will then calculate and pro rate the components across the distributions received throughout the year or period the trust was held.

Note: Sharesight receives finalised distribution components for ETFs that are processed via Computershare, so in most cases you will find that your Computershare distributions are already correct.

Note: Trust distributions are taxable based on the year in which they are earned by the trust. For some funds the ex date for the final distribution is set to the first business day in the new year. In this case Sharesight will correctly allocate the payment to the correct income year and as such it may appear to be future dated with respect to the report end date.

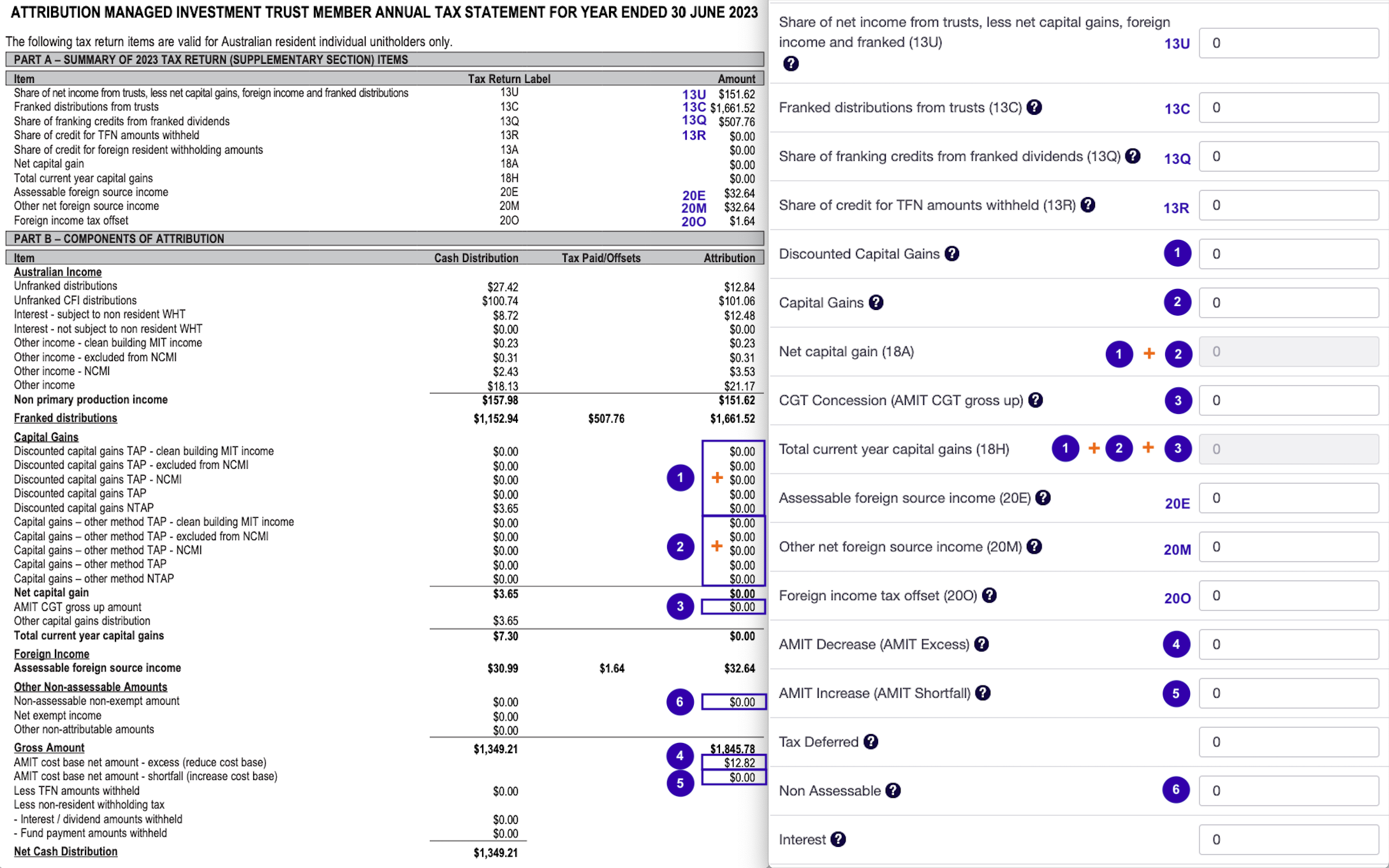

Form distribution taxable components:

Franked Amount - This value is net of the tax paid/franking credits. For attribution managed investment trusts (AMIT) this number is the total attributable franked amount minus the tax paid/franking credits and may not be displayed on the annual statement.

Unfranked Amount - Often referred to on annual statements as the Non primary production income. For AMITs you need to record the total attributable amount. Interest components can be included here for tax purposes.

Interest - It is not necessary to separate out interest from the total unfranked value for tax purposes. If you decide to do so, make sure to reduce the unfranked amount by the interest portion.

Tax Deferred - This amount is non-assessable and is used to adjust your cost base for CGT purposes. For AMITs this value should be left blank.

AMIT Decrease - Relevant for AMITs when the taxable income attributed to you is less than the cash distribution you received. This amount is non-assessable and is used to decrease your cost base for CGT purposes. This value is added to your gross amount as it represents cash received that was not attributed to you for tax purposes.

AMIT Increase - Relevant for AMITs when the taxable income attributed to you is more than the cash distribution you received. This amount is non-assessable and is used to increase your cost base for CGT purposes. This value is deducted from your gross amount as it reduces from your attributed income to the net cash amount you actually received.

Note: For AMITs that balance quarterly, you may see both AMIT Decrease and AMIT Increase components within a tax year. The difference between the two should match the AMIT value displayed on your statement.

Foreign Source Income - The gross amount of non Australian assessable income (before deduction of any tax paid/credits).

Discounted CGT - This is grossed up and included with your capital gains on the CGT report. You will often see two types of discounted gains on your statement. You need to enter the total of the two.

Capital Gains - Non discounted capital gains. This is included with your capital gains on the CGT report. You will often see two types of capital gains on your statement. You need to enter the total of the two.

CGT Concession - The amount of any CGT discount included on the statement. For AMITs this is referred to as the AMIT CGT gross up amount.

Non assessable - The amount of non assessable income. This is used to reduce your reduced cost base. It does not affect your cost base. For AMIT's this value should be left blank.

TFN Withholding Tax - The Amount of any Australian tax that has been deducted. This typically only occurs when your Tax File Number (TFN) has not been provided.

Foreign Tax - The amount of foreign tax paid/offset.

Franking Credits - The amount of franking credits attached to the distribution. This value will usually be found under the Tax Paid/Offsets column of the annual statement.

Other Net FSI - The amount of non Australian assessable income (before deduction of any tax credit) after offsetting any allowable expenses or losses relating to foreign source income. This value does not affect the gross amount.

Note: The ‘Net Amount’ and the ‘Recalculated Net Amount’ must be the same for the form to be correctly filled in.

Example:

Australian Income Totals section

This section provides the Australian total income and total franking credits.

Foreign Income table includes:

- Date Paid

- Exchange Rate

- Net Amount Foreign

- Foreign Tax withheld

- Gross Amount

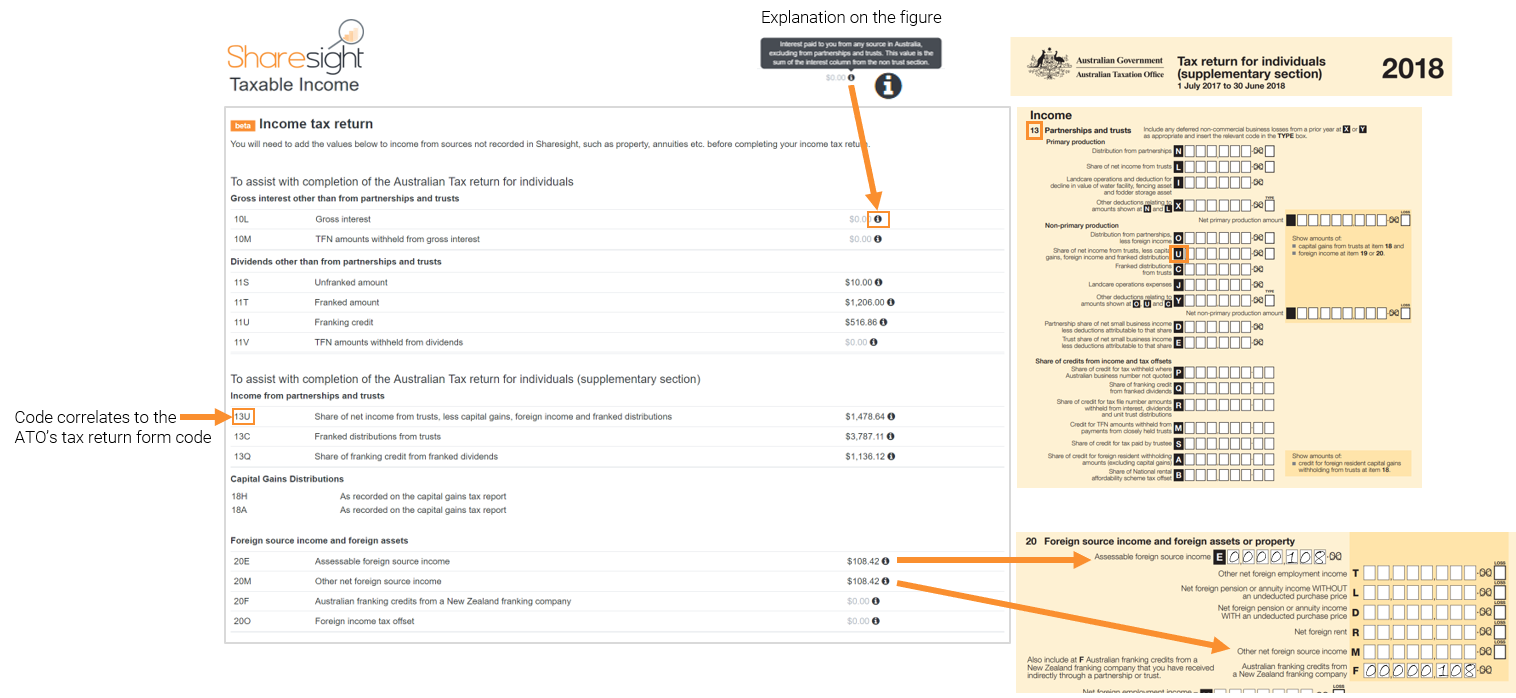

Income tax return

This section is only applicable for individual tax entities Australian Tax Residency portfolios. Your portfolio tax entity type can be set under portfolio tax settings

Note: The tax return field references are based on the tax return for individuals 2023 and tax return for individuals (supplementary section) 2023.

This section is a tool to designed to assist you in completing your Australian income tax return.

The code on the left of the Income tax return section correlates to the ATO’s tax return form code.

The information icon provides an explanation of the figure. ![]()

Remember: To add the values below to income from sources not recorded in Sharesight, such as property, annuities etc, before completing your income tax return.

Note: If you are on the Free plan and have more than 10 holdings the Income tax return section is not displayed as it would not report on your full portfolio. To run the report for more than 10 holdings upgrade your plan.

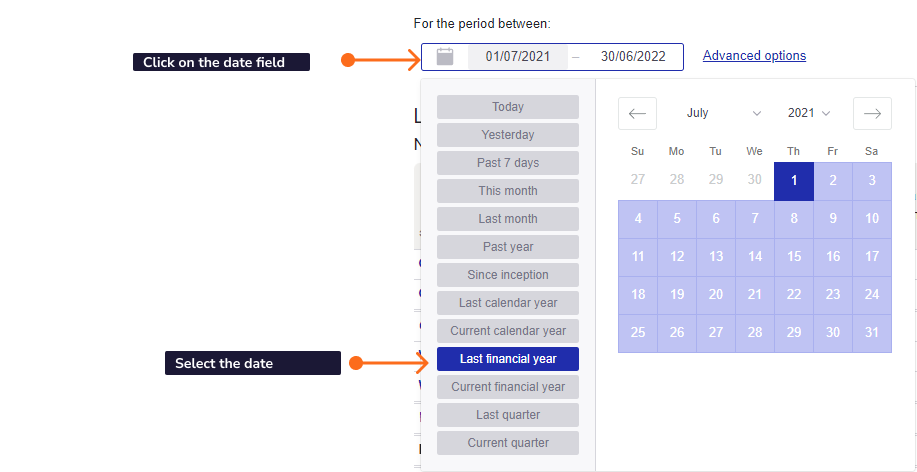

Running the Taxable Income Report:

1 – From any page click on the ‘Tax’ tab.

2 – Click the ‘Taxable Income Report’ tile.

3 – From the dropdown calendar, select the date range you would like to run the report in.

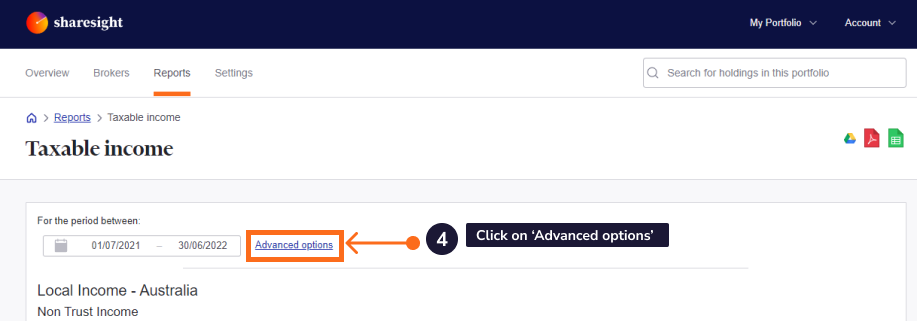

4 – Click ‘advanced options’ to choose to:

Show Comments - display any comments associated with a dividend or distribution.

Show holding totals - displays dividend or distribution totals across all payouts for a single investment. This is particularly useful for reconciling your Sharesight distribution data with the annual taxation statement you receive at the end of the tax year for each ETF, Managed Fund, or Unit Trust you own. This option needs to be selected to use the Trust pro rata distributions components form.

5 – Click ‘Apply’.

Disclaimer: Sharesight does not provide taxation advice and the reports do not constitute personal taxation advice. If you have any questions about your tax position we recommend you contact your accountant or tax advisor. You remain solely responsible for complying with all applicable accounting, tax and other laws.

Additional Resources, watch the using Sharesight to complete your tax return webinar recorded 24 June 2020. Learn how to use Sharesight to make completing your tax return quicker, easier and more accurate by Ben Clendon, Sharesight Product Manager.

Last updated 19th February 2026