How Sharesight helps you handle Australian LIC capital gain tax components

Content also available for tax entities or on our global site.What is a LIC

Listed Investment Companies (LICs) - as defined by the Australian Investor Association “are a subset of what the ASX calls listed managed investments. They enable an investor to invest in a diverse and professionally managed portfolio of assets which can include shares, property and interest bearing deposits.

LICs in Australia primarily invest in Australian or international shares and offer investors exposure to the same universe of assets that can be accessed through many unlisted managed funds.

LICs are bought and sold on the market just like an ordinary share and investors can decide whether the investment style and underlying investment portfolio of a particular LIC suits their own investment objectives.” For more information on LIC refer to AIS website.

How Sharesight helps account for LIC capital gain amounts in dividends

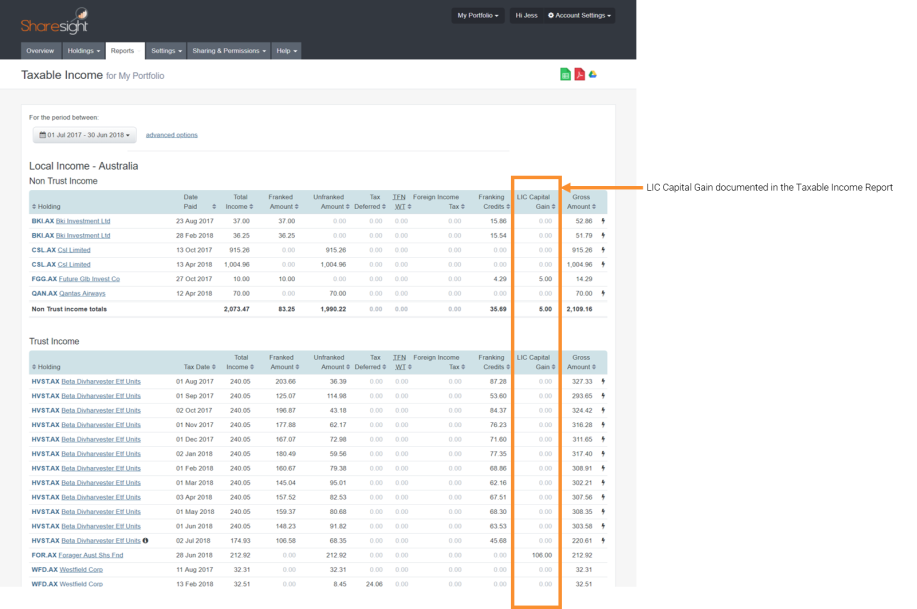

Within an Australian Tax Residency portfolio in Sharesight the dividend payment form has an optional field, ‘LIC Capital Gain’ enabling you to accurately account for LIC capital gain amounts manually once you receive the value from the LIC on your dividend statement. Once the LIC capital gain values have been added, Sharesight includes the values in the Taxable Income Report, and assist you in completing your Australian income tax return, by including the D8 Deduction section and calculating the amount of LIC capital gain that you can claim as a deduction at 50%, refer to the ATO for the taxes rules.

The ‘Deductions other than from partnerships and trusts’, D8 figure is 50% of the value of all LIC capital gain components. added to Sharesight from non trust investments.

Note: The Income return section in the Taxable Income Report is only displayed if the tax entity type is set to ‘Individual or Trust’ within an Australian Tax Residency portfolio portfolio.

The tax return field references are based on the tax return for individuals 2018 and tax return for individuals (supplementary section) 2018.

How to account for LIC capital gain amounts in dividends

1 – Within the LIC Individual Holding Page, click on the relevant dividend.

2 – On the ‘Edit a Payment’ form of the selected dividend, click on ‘+add another field’ dropdown beneath ‘Franking Credits’.

3 – Click on the dropdown list.

4 – Select ‘LIC Capital Gain’

5 – Type the amount of the dividend that is attributable to an LIC capital gain, this will be provided by the LIC on your dividend statement.

6 – Verify and adjust as needed the other details on the form and select ‘Save and confirm payout’.

Note: Please check the figures provided in the report against your actual dividend statements before using this information in your tax return. Sharesight relies on third party vendors for dividend information and we do our best to ensure that all data is as accurate as possible, however, Sharesight is not responsible for missing or inaccurate data.

Sharesight does not provide taxation advice and this report does not constitute personal taxation advice. If you have any questions about your tax position we recommend you contact your accountant or tax advisor.

Additional Resources, watch the using Sharesight to complete your tax return webinar recorded 24 June 2020. Learn how to use Sharesight to make completing your tax return quicker, easier and more accurate by Ben Clendon, Sharesight Product Manager.

Last modified on March 20, 2025 UTC