How can we help?

Simple and compound calculation

Sharesight gives you the option to see your portfolio (and holdings) return either in Simple or Compound return calculation.

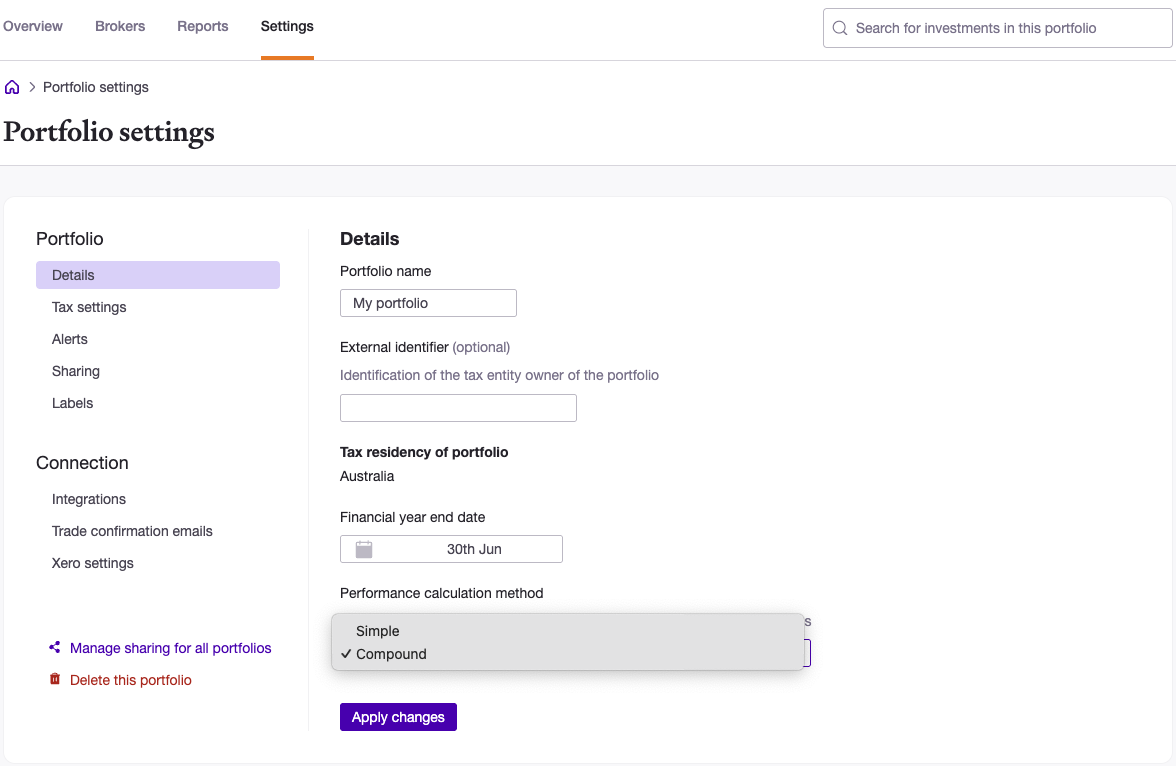

You can find this option under Performance calculation method in the Settings tab. This applies to both individual portfolio and consolidated view.

Simple vs compound return

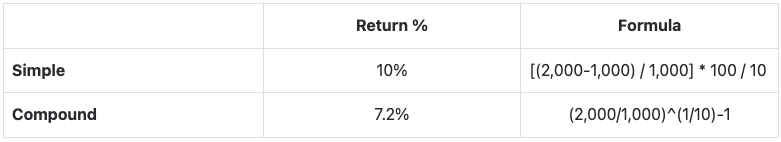

This example illustrates the difference between these two calculations. Assume a portfolio has:

Year 1: $100,000

Year 10: $200,000

Time period: 10 years

The return look as below.

The simple return is straightforward. The portfolio value doubled in 10 years, therefore the total return is 100% with annual return of 10%.

The compound return, or compound annual growth rate (CAGR), uses the exponentiation symbol (^) to calculate how investment returns accumulate over time, accounting for the compounding effect of growth on prior gains.

Which one should you use

There is no right or wrong answer. In saying that, compound return is the industry standard. When a fund manager publishes the fund's performance since inception, over a specific period, or benchmark against an index, they are all calculated in CAGR.

Same return for both calculation if measurement period is less than a year

If you calculate return over a 1-year period, simple return and CAGR will be the same because there’s no time for compounding to occur.

Consider the above example again. If the time period is 1 year instead of 10 years, both simple and compound calculation will show the same result of 100%.

For simple, it is [(200,000-100,000) / $100,000] * 100 / 1 = 100%

For compound, it is (200,000/100,000)^(1/1)-1 = 100%

Last updated 20th January 2026