How can we help?

Tax Residency of a Portfolio

The tax residency of your portfolio is the country you selected when you setup your Sharesight portfolio.

If you are on an Standard or Premium plan you can have multiple portfolios with different tax residencies in your Sharesight account.

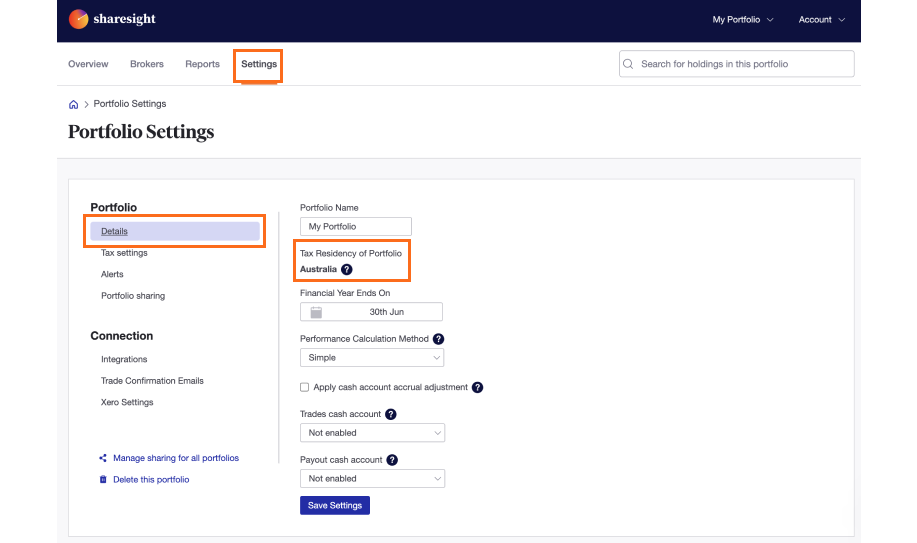

You can view the Tax residency of your portfolio in the ‘Settings’ tab under ‘Basic details’

Depending on the country you choose, this will determine:

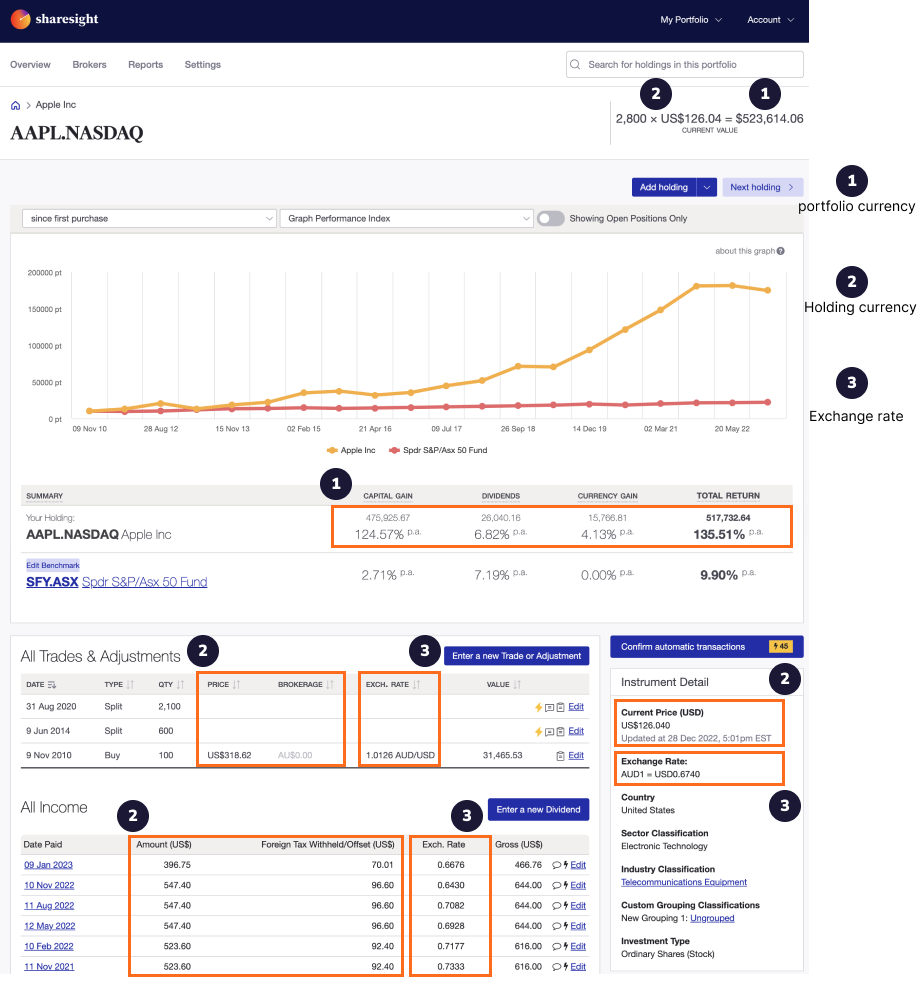

- Portfolio currency (e.g. USA = US dollar, etc.)

All holdings will be displayed in the portfolio currency. Foreign exchange and holdings traded in difference currency, will be automatically converted to the portfolio currency and show an exchange rate.

For example: A UK tax residency portfolio has Apple shares on the NASDAQ Stock Exchange.

Holding: Apple - USD Portfolio currency - GBP UK tax residency portfolio and exchange rate of USD to GBP.

- Functionality that relates to the tax requirements of the country, including:

- Reports for tax purposes

- Country specific data input requirements in transactions and Income windows

Note: Tax residency of a portfolio cannot be changed once it has been set up. This is due to the fact that all data is converted to the currency and calculated according to the tax requirements of the country.

Last updated 22nd January 2026