How can we help?

PIE distributions

Note: PIE distributions functionality is only available in New Zealand tax residency portfolios on Investor, Expert and Sharesight Pro plans.

In Sharesight, distributions from a listed Portfolio Investment Entity (PIE) are taxed differently to dividends from a listed company. A PIE distribution may contain both a fully imputed component and an excluded (unimputed) distribution component. The excluded portion of the distribution is not taxable and should not be included in your tax return.

You can choose whether to include the fully imputed portion of the distribution in your tax return. Typically you would only do this if your marginal tax rate is lower than the level of imputation credits attached (i.e. 28%).

Note: Please obtain professional tax advice if you are unsure as to the nature or correct treatment of PIE income.

Default treatment of PIE income in Sharesight

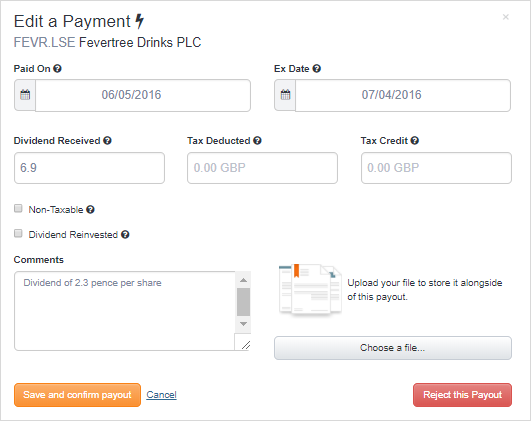

Due to a limitation in the data that is currently available via NZX, Sharesight cannot separate the excluded and fully imputed portions of the distribution; instead the total value of the distribution is recorded as a single line item. PIE fund distributions are marked as non-taxable by default, meaning that they are excluded from the taxable income report. You may override this setting by clicking on the dividend record to edit it and then de-selecting the 'non-taxable' tick box.

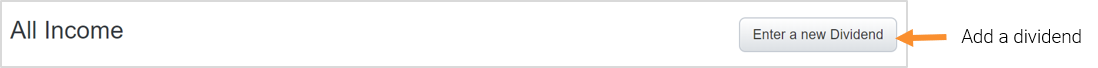

If you wish to separate out the excluded and fully imputed portions of the dividend this can be achieved by first editing the existing dividend record to reflect only the full imputed portion and then entering the excluded portion as a new dividend record using the 'Enter a new dividend' button.

Identification of PIE funds

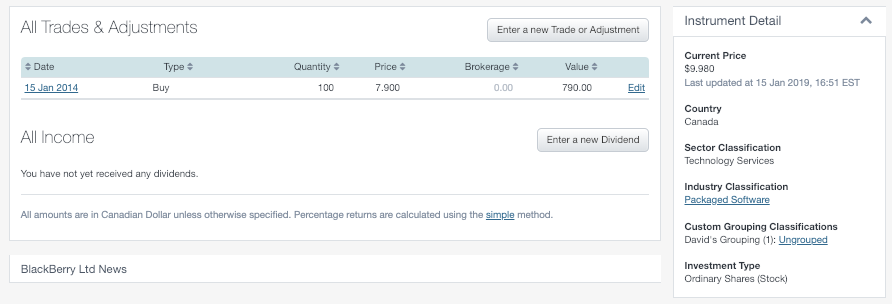

Sharesight manually maintains a list of NZX listed PIE funds. PIE funds will display the Security Type 'PIE Fund' under the Instrument Detail section on the right hand side of the individual share detail page. If you believe that a PIE fund has not been correctly identified, please contact us so that we can investigate and update our list if necessary.

Last updated 20th January 2026