How can we help?

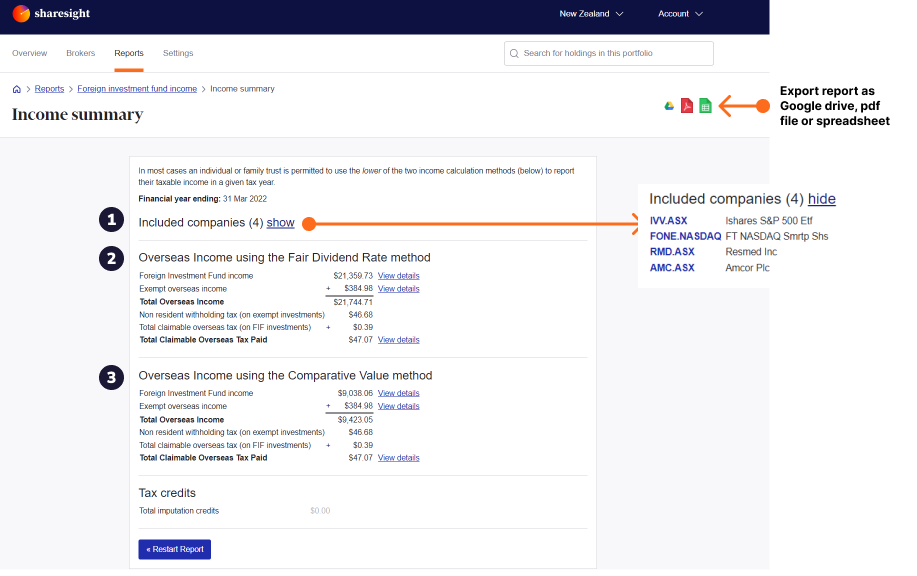

FIF Income Summary Page

The FIF Income Summary page is part of the FIF Report in Sharesight. It provides a summary of your taxable FIF income under the standard Fair Dividend Rate (FDR) method and the Comparative Value (CV) method.

Note: This report is only available in New Zealand tax residency portfolios on Expert and Sharesight Pro plans.

In most cases an individual or family trust is permitted to use the lower of the two income calculation methods to report their taxable income.

However only one method may be used in a given tax year. There are some circumstances where only one of the two methods may be used. Most notably, the CV method must be used for portfolio investments which have a guaranteed return.

Note: FIF Dividends are not taxed separately but any foreign withholding tax is still available as a foreign tax credit. Exempt FIF investments are taxed the same as New Zealand investments, i.e. they are taxable on dividends only.

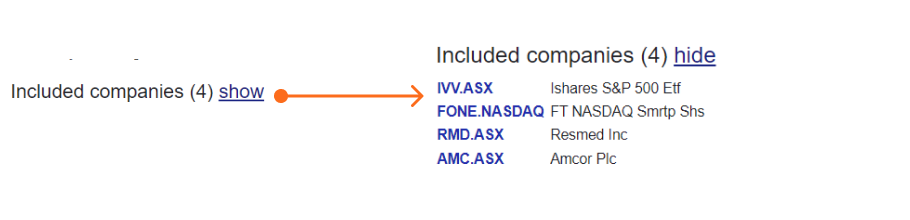

1. Included Companies - listed for reference. Click 'show' to view.

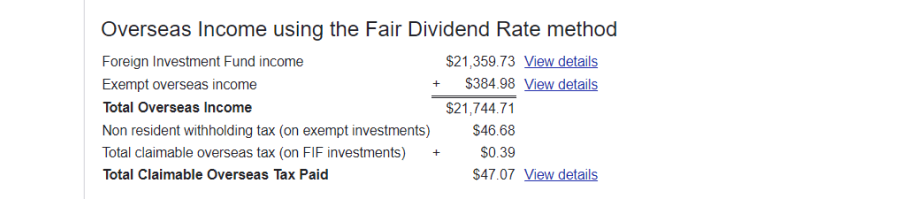

2. Overseas Income using the Fair Dividend Rate method - Under the Fair Dividend Rate method, tax is calculated on 5% of the share portfolio's opening market value each year. Generally, only shares held at the start of an income year are taken into account and therefore purchases and sales of shares during a year are ignored. However, shares that are purchased after the start of an income year and sold before the end of the same income year are taxed on the lower of 5% of their cost or the actual gains made on these "quick sales".

The following summary figures are provided:

- Foreign Investment Fund Income – This is your FIF income as determined by the FDR method.

Click on ‘View details’ link to see how each figure is derived in the FIF Fair Dividend Rate (FDR) Report.

- Exempt Overseas Income – This is your taxable income on shares that are exempt from FIF tax, these shares are taxed in the same way as New Zealand shares.

Click on ‘View details’ link to see the FIF Exempt Worksheet and view the FIF-Exempt Overseas Income & Overseas Tax Credits.

-

Total Overseas Income – This is the sum of Foreign Investment Fund Income + Foreign Investment Fund exempt income. Assuming that you have no other offshore investments, this figure is what should be entered into the total overseas income section of your IR3 tax return.

-

Total (Claimable) Overseas Tax Paid – This is the total claimable withholding tax that has been paid on all Australian shares (whether exempt from FIF or not). Assuming that you have no other offshore investments, this figure is what should be entered into the total overseas tax paid section of your IR3 tax return.

Click on ‘View details’ link to see the FIF Exempt Worksheet and view the FIF-Exempt Overseas Income & Overseas Tax Credits.

Note: FIF tax credits can only be used to reduce the income tax payable on your FIF income. If there is no New Zealand income tax payable on your FIF investments, no claim can be made for the overseas tax paid on any dividends received by an FIF.

On the Income Summary page Sharesight displays either the total tax credits, or the total claimable tax credits as appropriate.

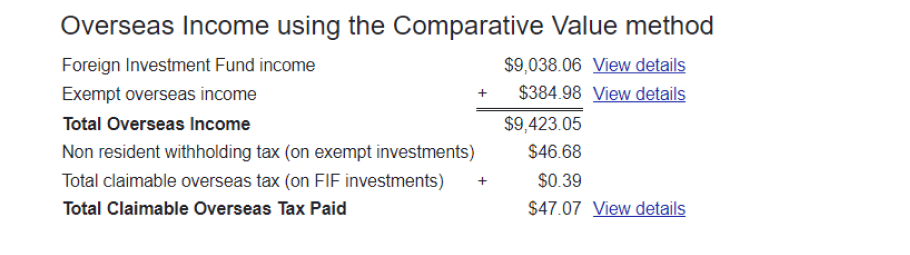

3. Overseas Income using the Comparative Value method - The comparative value method takes into account capital gains and dividends from FIF investments. The total return is calculated using the comparative value formula in section EX 44 of the Income Tax Act 2004: (closing market value of shares held + total sales proceeds + dividends received) - (opening market value of shares held + total value of purchases) No tax is payable when the total return is nil or negative. Foreign investment fund losses cannot be carried forward.

The following summary figures are provided:

- Foreign Investment Fund Income – This is your FIF income as determined by the CV method.

Click on ‘View details’ link to see the FIF Comparative Value (CV) Report and view the FIF-Exempt Overseas Income & Overseas Tax Credits.

- Exempt Overseas Income – This is your taxable income on shares that are exempt from FIF tax, these shares are taxed in the same way as NZ shares.

Click on ‘View details’ link to see the FIF Exempt Worksheet and view the FIF-Exempt Overseas Income & Overseas Tax Credits.

-

Total Overseas Income – This is the sum of Foreign Investment Fund Income + Foreign Investment Fund exempt income. Assuming that you have no other offshore investments, this figure is what should be entered into the total overseas income section of your IR3 tax return.

-

Total Overseas Tax Paid – This is the total withholding tax that has been paid on all Australian shares (whether exempt from FIF or not). Assuming that you have no other offshore investments, this figure is what should be entered into the total overseas tax paid section of your IR3 tax return. Click on the ‘view details’ link to see how each figure is derived.

Click on ‘View details’ link to see the FIF Exempt Worksheet and view the FIF-Exempt Overseas Income & Overseas Tax Credits.

Last updated 20th January 2026