How can we help?

Components return

All percentage returns including component returns (dividend gain, capital gain and currency gain) are calculated using the same methodology as described above. When calculating component returns, the figures for the capital invested (denominator) and average years invested (AYI) remain the same, with the gain (numerator) varied accordingly.

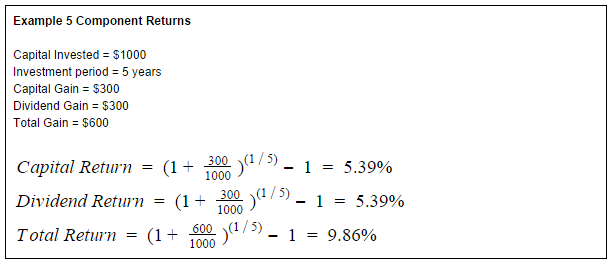

It’s important to note that in the compounding context, the component return percentages will not directly sum to the total. To illustrate why this is so, consider the following example:

Example 5 demonstrates that a 5.39% dividend return combined with a 5.39% capital return equates to a 9.86% total return. If we were to simply sum the two component returns we would not arrive at the correct answer. This is because in the compounding context the relationship between the percentage return and the dollar return is exponential rather than linear.

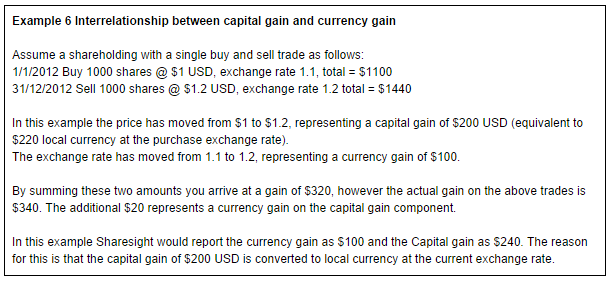

Another factor to consider in relation to component returns is the interrelationship between the capital gain and the currency gain. As the capital return on a foreign investment is converted to local currency at the current exchange rate, there is a currency gain on the capital gain component in addition to the currency gain on the capital invested. Sharesight reports the currency gain purely in relation to the currency movement on the invested capital.

Cryptocurrency

Sharesight treats cryptocurrencies as currencies* rather than traditional assets. This means that any change in the crypto’s value relative to a fiat currency (like USD or AUD) is classified as a currency gain or loss, not a capital gain or loss.

As a result, you’ll likely notice a negative capital gain in your crypto return. This is usually due to transaction fees or wallet transfer fees, rather than market performance.

*Note: This classification is based on how Sharesight handles cryptocurrencies for technical purposes. It doesn’t reflect Sharesight’s stance on what crypto should be considered.

Last updated 21st January 2026