How can we help?

FIF Report

Available in New Zealand on Premium and Sharesight Business plans.

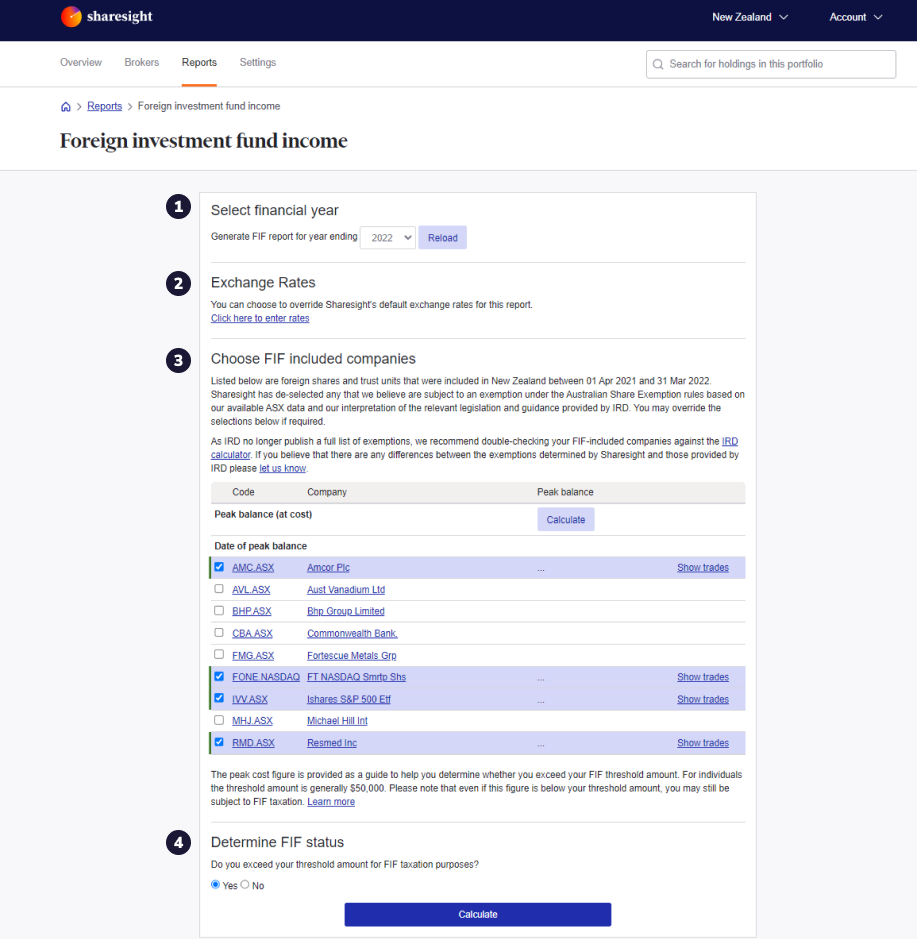

The Foreign Investment Fund (FIF) Sharesight report is a multi page report that provides the various calculations required FIF tax reporting.

Learn more about calculating your 2019-2020 foreign income fund / FIF income for filing your IR3 individual income return with the New Zealand IRD, using Sharesight's FIF Report from the lastest FIF blog..

The first page of the report allows you to select the set of criteria that will be used to run the report.

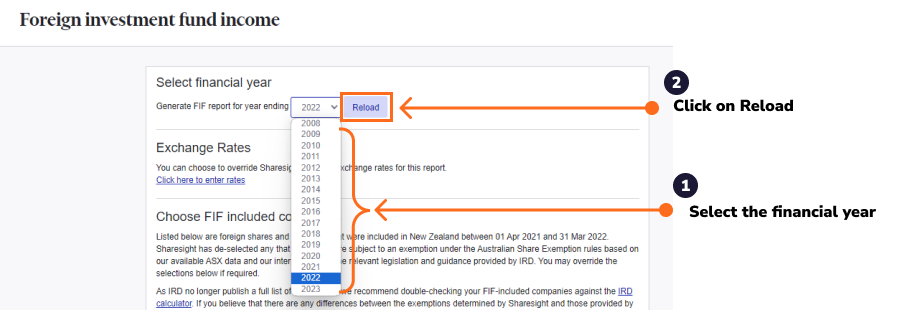

1. Select financial year - select the financial year that you wish to run the report in, from the dropdown list.

Then click 'Reload'. This will reload the FIF report in the selected financial year.

By default the financial year for a New Zealand tax residency portfolio begins at 1 April and ends at 31 March. The financial year can be altered in a portfolio within the 'Settings' tab.

Note: If the word "DRAFT" is indicated, this means that the list of excluded companies (see below) has not yet been verified against the Australian Share Exemption List IR871 as published each year by IRD. Sharesight updates the list of exempt companies as soon as possible once the Australian Share Exemption List IR871 has been published.

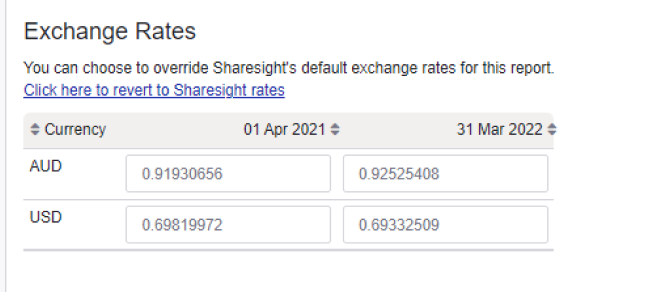

2. Exchange Rate - Sharesight applies its data providers exchange rates as default. These can be edit as required by click on ‘Click here to enter rates’ and then editing the exchange rates.

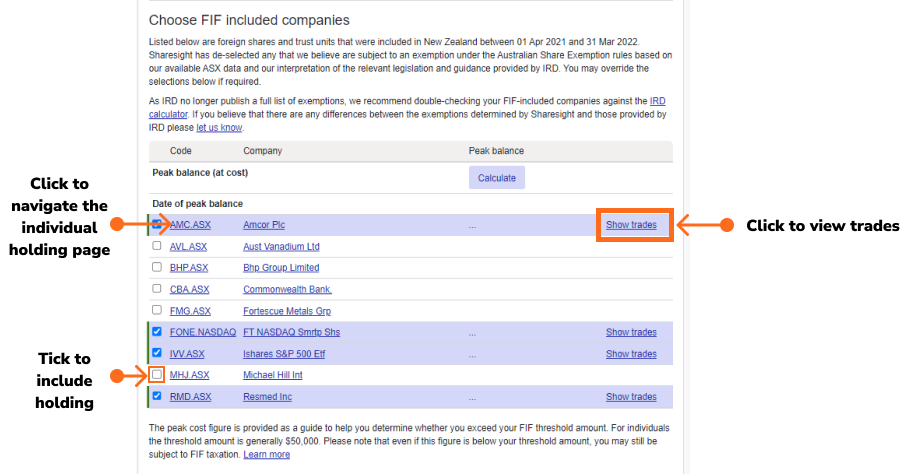

3. Choose FIF included companies - This section shows all overseas shares in the portfolio. Ticked and green holdings indicates shares to be included in the FIF report.

Holdings can be selected and deselected by clicking on the tick box on the holding.

Click ‘Show trades’ to view the cost price trades being included in the FIF report.

Click on the holding code or name to navigate to the Holding Individual Page.

Sharesight uses the Australian Share exemption list (IR 871) as published each year by the IRD, to determine which shares are exempt from FIF. As shares can move in and out of an approved index during the year, for a share to be exempt it must be on an approved index either at the start of the year, or when you acquired the shares if you did not hold shares in the company at the start of the year. The Sharesight FIF report takes these rules into account when determining which shares to include in the report.

Note: Under section EX 33C of the Income Tax Act 2004, investments in Australian-resident companies listed on an approved index of the Australian Stock Exchange, such as the All Ordinaries index (the 500 largest listed companies) are generally exempt from the foreign investment fund rules and are taxed the same as New Zealand investments. Sharesight automatically de-selects any companies that are exempt from the FIF tax regime.

4. Determine FIF status - In order for the FIF taxation rules to apply to individuals, the cost price of offshore investments must exceed a prescribed threshold amount defined as the total purchase price of all shares.

For individuals the FIF threshold amount is generally $50,000, however for jointly held shares a $100,000 threshold is usually applicable. There is no threshold for trusts.

The threshold amount is shown on the list of included companies and is calculated using the First-In-First-Out (FIFO) method as prescribed in section EX 68 of the Income Tax Act 2004.

You are subject to FIF if the cost price balance of your shares exceeds your threshold at any stage during the year (i.e. additional purchases during the year may cause you to exceed your threshold), hence Sharesight calculates your 'peak balance' during the year and displays the peak balance date for your reference.

Note: Even if the total cost price displayed is less than your threshold amount you may still be liable for FIF taxation if you have other offshore investments that are not recorded in Sharesight.

If you exceeded your threshold amount select ‘Yes’.

5. Click the ‘calculate’ button.

A summary page outlining your taxable income under the FIF rules will be calculated. If you do not exceed the threshold amount you will be directed to the standard Taxable Income Report.

SEE ALSO

Last updated 20th January 2026