How can we help?

Fresh and Recycled Capital

Recycled capital is the proceeds received from selling an asset to buy the same or a new asset.

For capital to be considered recycled, the new investment's (or same investment) purchase date must be a day or more after the proceeds from the sale of the previous investment.

Sharesight excludes recycled capital from holding return to avoid understating return. For example, if you bought a stock with a capital of $10,000, sold it for $15,000 (a gain of $5,000) before buying again for $13,000. Sharesight only considered the invested capital as $10,000 because the 2nd purchase is funded by the proceeds.

Example

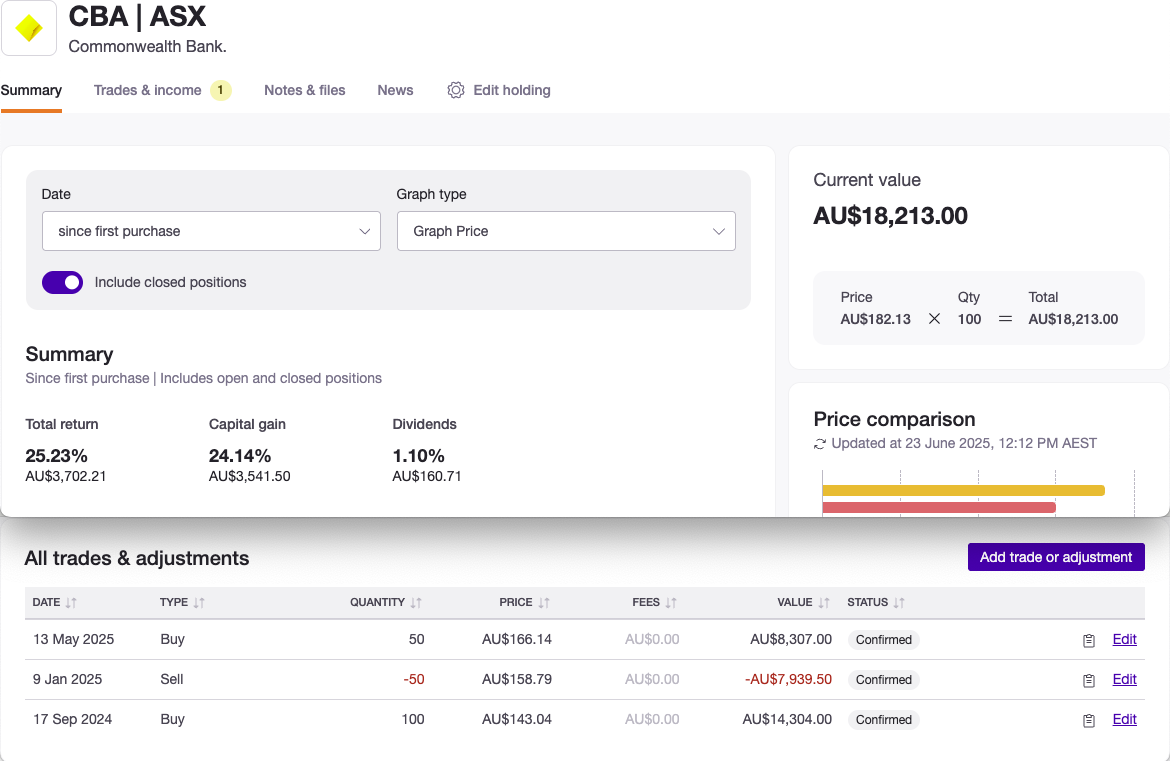

Let's use CBA.ASX as another example.

The capital return is 24.14%. That is calculated using a total capital gain of $3,541.50 and a total invested capital of $14,672.50.

3,541.50/14,672.50 = 24.14%

Where does $14,672.50 come from?

The first purchase has an invested capital of $14,304. While the second purchase has an invested capital of $8,307, which $7,939.50 is considered recycled and excluded. As a result, only $367.50 is added to derive the total invested capital of $14,672.50.

Last updated 20th January 2026