How can we help?

Mergers

The ‘Merge this Holding’ feature is designed to record a company merger in the situation where you hold shares in a listed company that is wholly acquired by another listed company.

To record a company merger, perform the following steps:

1 - Click on the stock that has been acquired on the Portfolio Overview Page, to go to Individual Holding Page.

2- Select ‘Edit holding’ tab and click the ‘Merge this holding’ button.

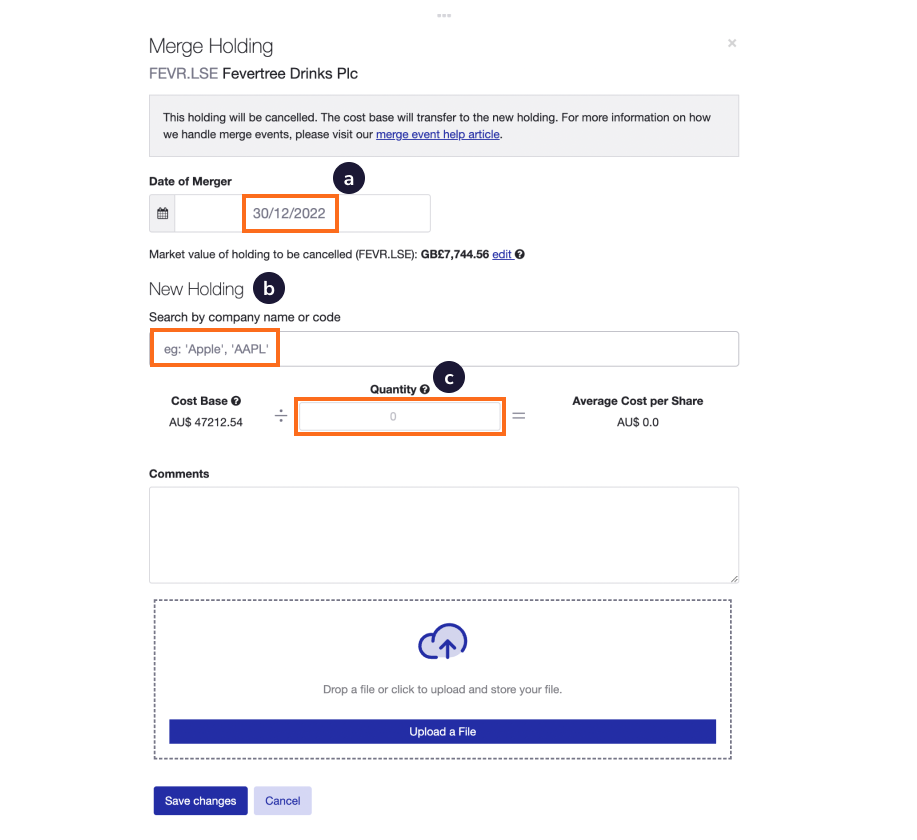

3- Enter the following three values: a. Date of merger b. New Holding c. Quantity

Click the “Save changes” button and Sharesight will do the rest.

FAQ's

When should I use the merge feature? This feature is designed to be used if you have a holding that has been merged into another holding.

What happens to the cost base of the cancelled holding? The cost base of the cancelled holding will be transferred across to the new holding.

How does Sharesight track the performance of the cancelled holding? By default Sharesight captures the market value of the shares that are cancelled and uses that value to illustrate the performance of the cancelled holding up until the merge date.

Importantly, Sharesight also uses the same figure as the market value of the new holding. This ensures that no performance is ‘lost’ from your portfolio as a result of the merge event.

You also have the option of adjusting the default market value that will be captured as a result of the merger.

Where do I find the quantity for the new holding? Typically the companies subject to the merger will announce a ratio that will be used to calculate how many new shares to allocate to the new holding based on your current holding.

You should also receive notifications from the companies subject to the merger informing you of the quantity of new shares you will receive.

What happens if I already own shares in both companies? Additional shares acquired as a result of the merger will simply be added to your existing holding.

What happens when I save the merge event? Sharesight creates a merge (cancel) transaction against the cancelled holding. This transaction is similar to to a sell trade.

Sharesight also creates a merge (buy) transaction that displays within the new holding and contains both the cost base and market value from the cancelled holding.

What happens when I sell the new shares acquired in the merger? An immediate CGT event will occur. Sharesight will link it back through to the Merge (cancelled) holding to retrieve the remaining unsold share parcels, fetch the original purchase history prior to a merge event in order to correctly calculate the CGT.

Example:

Consider the following double merge events. Silver Chef Limited (SIV.ASX) is merged with Emeco Holdings (EHL.ASX) which is in turn later merged with Hotel Property (HPI.ASX)

SIV.ASX > EHL.ASX > HPI.ASX

If a Sell trade is added to HPI shares and a Merge (buy) trade exists Sharesight will follow the history back through to EHL. Since EHL also has a Merge (buy) trade, the system will follow that back through to SIV and so on to retrieve the original Buy price.

Important Disclaimer: We do not provide tax advice. Make sure you seek appropriate tax advice before implementing the ideas in this article.

Last updated 21st January 2026