How can we help?

FIF Comparative Value (CV) Report

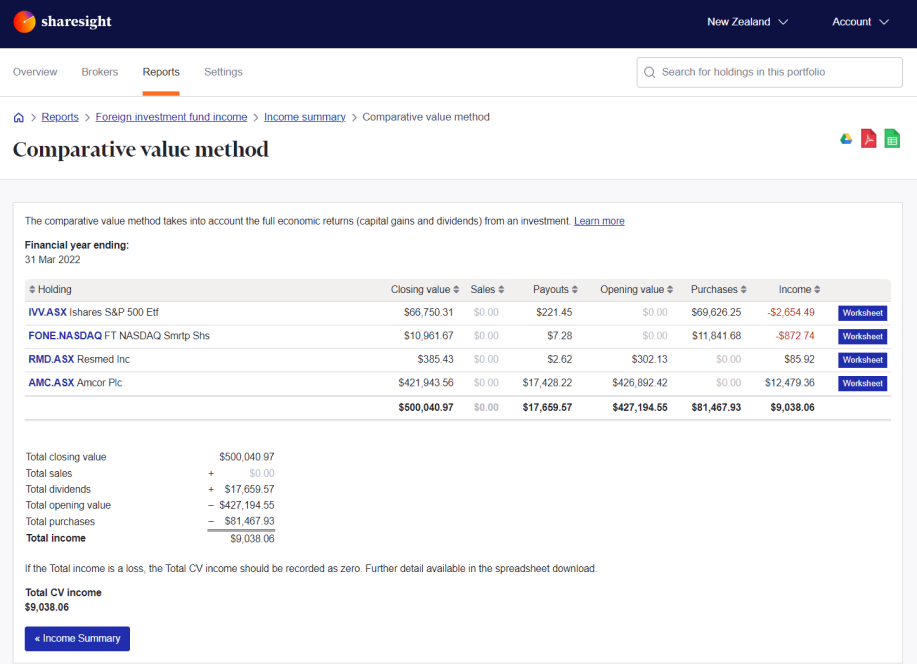

The FIF Comparative Value Report is part of the FIF Report available within Sharesight. It takes into account capital gains and dividends from an investment.

Note: This report is only available in New Zealand tax residency portfolios on Premium and Sharesight Business plans.

The total return is calculated using the comparative value formula in section EX 44 of the Income Tax Act 2004:

(closing market value of shares held + total sales proceeds + dividends received) - (opening market value of shares held + total value of purchases).

No tax is payable when the total return is nil or negative. Foreign investment fund losses cannot be carried forward.

The table shows the information for each FIF holding that is required to calculate the amount of taxable income using the Comparative Value method. The table shows all figures in NZD, the opening and closing exchange rates used are printed above the table. For clarity, the Comparative Value Calculation is detailed below the table.

Last updated 20th January 2026