How can we help?

Opening Balance

Use market price for return calculation

When you add a holding as an Opening Balance trade, Sharesight uses the market price of the opening balance date to calculate capital gain return.

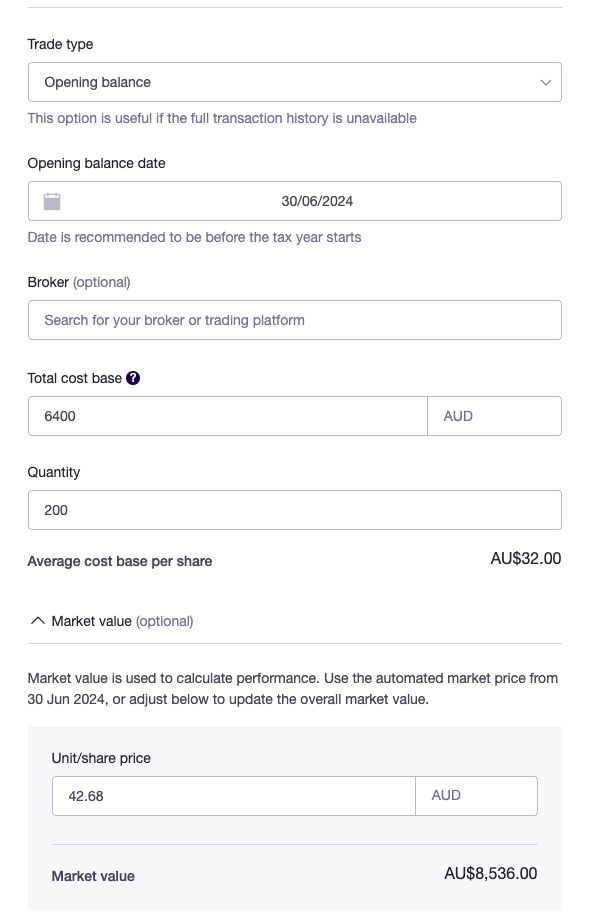

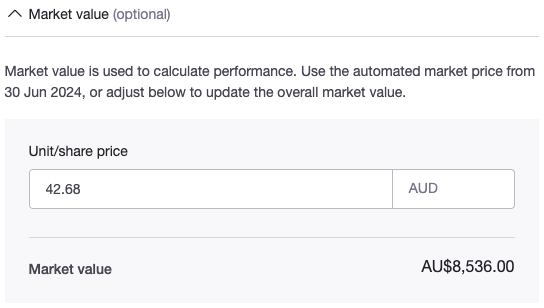

To use a simple example where a holding has an opening balance trade on 30 June 2024. Instead of using the $32 average purchase price (or cost base) to calculate return, Sharesight uses the market price of 30 June 2024, which is $42.68.

Why Sharesight Uses the Market Price for Opening Balance

Sharesight uses the market price when entering an opening balance to avoid skewing return calculations.

Opening balances are useful in two situations:

- You have missing buy and/or sell records.

- You have too many historical trades (hundreds or thousands), and entering them all would be impractical.

In either case, using an opening balance allows you to track your holdings without the need to locate every trade. All you need is the most recent quantity and either the average cost base or total cost base.

However, this has a trade-off: you need to choose an arbitrary date for the opening balance—one that may not reflect the actual purchase date of your shares.

This matters because Sharesight uses a money-weighted return (MWR) method, which is sensitive to the timing of cash flows. The date you choose for the opening balance directly affects the calculated return.

For example, let’s say you’ve held a stock for over 10 years. You don’t remember the exact purchase date, but you know your average purchase price was $10. If you enter an opening balance dated 1 January 2025, and the current market price on 25 June 2025 is $50, Sharesight will calculate a 400% return over just six months. This overstates your performance and distorts your portfolio’s overall return.

Using average purchase to calculate return

The example above is an extreme case, but it illustrates why Sharesight uses the market price—rather than the average cost base—when calculating returns for opening balances. While not a perfect solution, using the market price helps minimise the risk of inflated or misleading performance figures.

That said, if you prefer your returns to reflect your actual cost base, you can override the market price by manually entering your average purchase price in the Unit/Share price field under the Market value section when setting up the opening balance. This allows Sharesight to calculate returns based on your true cost, rather than the market price on the selected date.

Last updated 20th January 2026